retroactive capital gains tax september 2021

The current maximum 20 rate. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive.

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year.

. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be. Signed 5 August 1997. Biden plans to increase this.

The Treasury Greenbook is a summary explanation of an. Sellers to insure the risk of a retroactive capital gains rate increase. I read that it would be unconstitutional and struck down in the courts if Biden attempts to try to make his still-unpassed elimination of long-term capital gains rates.

Effective for taxable years ending after 6 May 1997 ie for. Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds. Some of these provisions if enacted would have effective dates retroactive to the date the legislation was proposed September 13 2021.

Reduced the maximum capital gains rate from 28 percent to 20 percent. FAQ on capital gains outlook and effective date. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

On The Retroactive Capital Gains Tax Hike. A true tax hike. The capital gains tax increase as of September 13 2021 there are no retroactive taxes in the proposal affecting individuals estates or trusts.

So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from. If you live in a state that taxes capital gains youre going to see an additional tax on top of it leaving certain individuals with marginal capital gains rates past 40. A retroactive to April or May of 2021 increase in long-term capital.

The higher rate will be effective for qualified dividends paid or sales that occur on or after September 13 2021 when the proposal was released. AUGUST 11 2021 BYJOE BISHOP-HENCHMAN. Some of these provisions if.

Will cool as the threat of a capital gains tax hike becomes more likely in. A Retroactive Capital Gains Tax Increase. An exception to this retroactive.

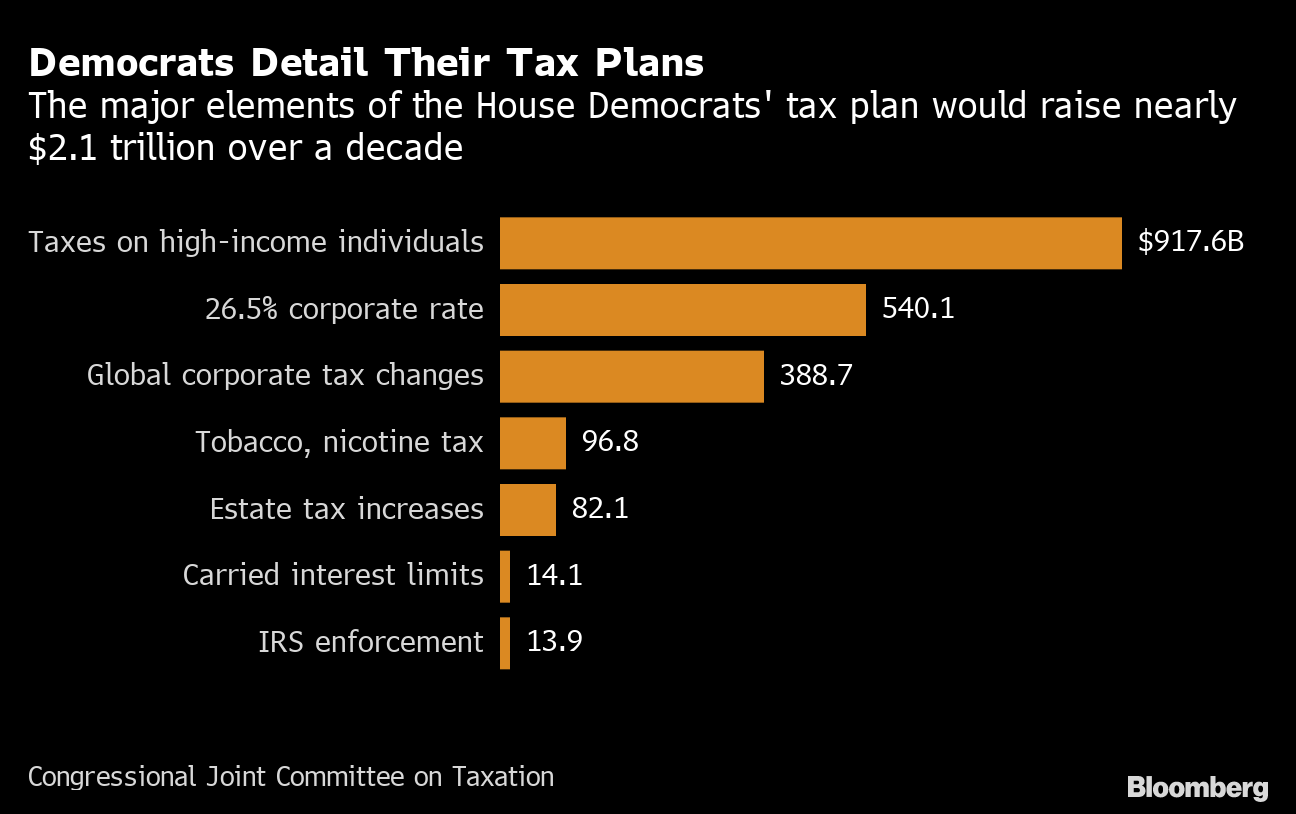

The treatment of gifts at death as sales that require capital gains tax to be paid on amounts over 1 million. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation. On May 28th 2021 the United States Department of the Treasury published the Greenbook for the Biden Administration Budget Plan.

September 13 2021 1200 AM. Retroactive Capital Gains Tax Hike. The Presidents proposed 434 capital gain rate is supposed to hit only those earning 1M or more but if you bought a house 30 years ago that is now worth over 1M you.

7 rows Introduced 24 June 1997.

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

House Democrats Propose Hiking Capital Gains Tax To 28 8

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

Richest Americans Want Clarity On Tax Hikes So They Can Avoid Them Bloomberg

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

What You Need To Know About Capital Gains Tax

Biden S Proposed Retroactive Capital Gains Tax Increase

Patrick Are Capital Gains Taxes Changing Local News Valdostadailytimes Com

Tax Changes For 2022 Kiplinger

Capital Gains Tax Hike And More May Come Just After Labor Day